4 Ways New Exchanges Will Radically Alter Health Insurance

4 Ways New Exchanges Will Radically Alter Health Insurance  5 Obamacare Scams And How To Avoid Them

5 Obamacare Scams And How To Avoid Them By Jean Folger

As part of the Affordable Care Act, the new Health Insurance Marketplace (or “Exchange”) opens for business on Oct. 1, 2013. The Marketplace is an online, one-stop shopping experience for health coverage designed to make it easier for individuals and families to compare and purchase insurance. Each state has its own Marketplace, which offers a variety of plans from participating health insurance companies.

In addition to finding health coverage, you can use the Marketplace to find out if you qualify for money-saving federal subsidies, including Cost-Sharing Reductions, which can lower your out-of-pocket costs, and Advanced Premium Tax Credits, which lower your monthly premiums. These subsidies are available only on the Marketplace, and can make a significant difference in the type of coverage you might be able to afford. During open enrollment, which runs from Oct. 1 through March 31, 2014, you can set up an account and fill out the online application on your state’s Marketplace to see the health coverage options available to you and find out if you qualify for subsidies.

Regardless of where you live, all plans in the Marketplace are separated into four “metallic” levels – Bronze, Silver, Gold and Platinum – based on how you and the plan can expect to share your health care costs. Here, we explain the different coverage levels and define some key terms to help you decide among Bronze, Silver, Gold and Platinum health insurance plans.

Understanding Out-of-Pocket Costs

When you purchase health insurance, the amount you pay for the coverage each month is called the premium. You pay this whether or not you go to the doctor, visit the hospital or buy prescription medications. When and if you do receive health care, your costs – above and beyond the premium – are based on your plan’s deductible, copayment, coinsurance and out-of-pocket maximum. In order to make informed choices when comparing and purchasing health care plans, it is important to understand what these terms mean.

A deductible is the amount you have to pay for covered services before your insurance starts to pay. For instance, if you have a $2,000 deductible, you will pay 100% of your health care expenses until the amount you have paid reaches $2,000. After you meet your deductible, some service might be covered at 100% while others would require you to pay coinsurance (more on that below).

A copayment (sometimes called “copay”) is a fixed dollar amount that you pay for certain health care services. Typically, you will have different copayment amounts for different types of service, such as a $25 copayment for a doctor’s office visit or a $150 copayment for an emergency room visit. In most cases, any copayments you make do not count toward your deductible.

Your share of the costs of a health care service is called coinsurance. Typically, this is figured as a fixed percentage of the total charge for a service, such as 15% or 30%. Coinsurance kicks in after you’ve met your deductible. For example, assume you’ve already met your $2,000 deductible and your plan’s coinsurance is 15%. If you have a hospital charge of $1,000, your share of the costs would be $150 (15% of $1,000). If your coinsurance was 30%, your share would be $300.

A plan’s out-of-pocket maximum (or out-of-pocket limit) is the most you pay during a policy period (typically a year) before your plan starts to pay 100% of the allowed amount. The money you pay for premiums and health care that your plan doesn’t cover (e.g. elective surgery) does not count towards your out-of-pocket maximum. Depending on your plan, your deductible, copayments and/or coinsurance may apply towards the out-of-pocket maximum. The various health care plans have different out-of-pocket maximums; however, under health care reform, the 2014 limits are $6,350 for individuals and $12,700 for families.

Essential Health Benefits

For an insurance company to participate in the Marketplace, it must offer at least Silver and Gold plans. No matter what plan you choose – Bronze, Silver, Gold or Platinum – the same set of Essential Health Benefits will be covered:

•Addiction treatment

•Ambulatory patient services

•Care for newborns and children

•Chronic disease treatment (such as diabetes and asthma)

•Emergency services

•Hospitalization

•Laboratory services

•Maternity care

•Mental health services

•Occupational and physical therapy

•Prescription drugs

•Preventive and wellness services (such as vaccines and cancer screenings)

•Speech-language therapy

Covered benefits are the health care services that your insurer pays for under your plan. You may still be required to pay a copayment or coinsurance, but the service is recognized by your plan. By comparison, if a service is not covered – such as an elective surgery or chiropractic care – you would be responsible for 100% of the associated costs.

The Essential Health Benefits are the minimum requirements for all plans in the Marketplace; certain plans will offer additional coverage, but no plan can offer less.

Actuarial Value

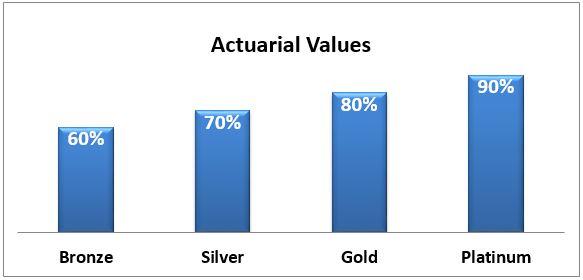

The four levels of health plans – Bronze, Silver, Gold and Platinum – are differentiated based on their actuarial value: the average percentage of health care expenses that will be paid by the plan. The higher the actuarial value (i.e. Gold and Platinum), the more the plan will pay towards your health care expenses and, therefore, the lower your out-of-pocket costs for things such as:

•Deductibles – the amount you owe for covered services before insurance kicks in;

•Copayments – a fixed amount you pay for a covered health care service; and

•Coinsurance – your share of the costs of a covered health care service.

The downside to the plans that provide more coverage is that you will pay a higher premium each month.

On average, a Bronze plan will cover 60% of covered medical expenses, and your share will be the remaining 40%. The actuarial value of each type of plan is shown here:

Your share of costs might come in the form of a large deductible with low coinsurance once you’ve met your deductible. Another plan might offer a low deductible with higher coinsurance. For example, Silver Plan A (which generally pays 70% of your health care expenses) offers a high $2,000 deductible and a low 15% coinsurance. Silver Plan B, on the other hand, has a low $250 deductible but a higher 30% coinsurance.

How Much will it Cost?

For any plan, your monthly premium will be based on several factors including:

•Your age

•Whether or not you smoke (in some states you will pay a “surcharge” if you are a smoker)

•Where you live

•How many people are enrolling with you (spouse and/or child)

•Your insurance company

Since your state’s Marketplace allows various private insurers to offer plans, a Silver plan from one company may cost more or less than the same plan offered by a different insurer. Plans offered by the same company, however, will increase in price as the actuarial value and the amount the plan pays go up. Starting in 2014 the federal limit for annual out-of-pocket expense for individuals (not including monthly premiums) is expected to be capped at $6,350; the family cap is $12,700. Certain plans may have even lower out-of-pocket caps.

How to Decide Which Plan is Best for You

Deciding which plan is best for you can be a challenge. You will have to consider your health and your financial situation as you compare plans. In general, if you expect to have a lot of health care visits or require regular prescriptions, you may be better off with a Gold or Platinum plan that pays a higher percentage of the costs. If, on the other hand, you are by-and-large healthy and don’t expect to have many health care bills, you might be comfortable choosing a Bronze or Silver plan. Of course, even healthy people can have accidents or become ill and end up with lots of medical bills, so you have to factor in your risk tolerance as well.

If your income falls between 100 and 250% of the federal poverty level ($11,490 to $28,725 for an individual), you may be eligible for a Cost-Sharing Reduction subsidy, which can help lower your deductibles, copayments and coinsurance. In order to receive Cost-Sharing Reductions, you must purchase a Silver plan on the Marketplace. You will still have a variety of plans from which to choose, but it must be Silver to be able to take advantage of the Cost-Sharing Reduction subsidy.

Many people will qualify for Advanced Premium Tax Credits, a type of subsidy that lowers your monthly premium. You may be eligible for this subsidy if your income falls between 100 and 400% of the federal poverty level ($11,490 to $45,960 for an individual).

Tip: The Cost-Sharing Reduction and Advanced Premium Tax Credits subsidies are not automatic: you must apply for them on the Health Insurance Marketplace.

The Bottom Line

When choosing a plan, it is helpful to remember that all plans – Bronze, Silver, Gold and Platinum – cover the same Essential Health Benefits. Your monthly health insurance premium will be higher if you choose a higher level plan, such as Gold or Platinum. But you will also pay less each time you visit a health care provider or get a prescription filled. Conversely, your monthly premium will be lower if you choose a Bronze or Silver plan, but you will pay more for each doctor visit, prescription or health care service that you use.

Finding a balance between coverage and costs can be challenging. Starting October 1, you will be able to compare plans on the Marketplace to find the coverage that is the best fit for your financial situation and health care needs. You will also be able to apply for federal subsidies that can help reduce your health care costs.

Also From Investopedia:

5 Things You Should Know About The New Health Insurance Marketplace

The Advantages of Vacation Insurance

4 Credit Card Rewards Gimmicks Revealed

Get An Academic Finance Career

When Things Go Awry, Insurers Get Reinsured

0 comments:

Post a Comment

Click to see the code!

To insert emoticon you must added at least one space before the code.